- Anúncios -

O que significa bomb?

O termo "bomb" pode ter diversos significados em diferentes contextos. Na língua portuguesa, pode se referir a uma explosão, ao consumo excessivo de drogas ou ainda a uma canção de grande sucesso. É importante compreender o contexto para atribuir o significado correto à palavra "bomb".

O que significa headline?

Você já se perguntou o que significa headline? Conhecido como título principal, o headline é a frase que resume o conteúdo de uma matéria, chamando a atenção do leitor e despertando o interesse em continuar a leitura. Elaborar um headline atrativo e impactante é essencial para captar a audiência.

O que significa bed?

O que significa bed? Essa simplicidade de três letras carrega um mundo inteiro de significados. É o refúgio para o cansaço e o abrigo para os sonhos. Onde nos entregamos ao descanso e despertamos para um novo dia. Uma peça tão simples, mas tão essencial em nossas vidas, que nos convida a explorar o conforto e a paz que reside…

Medicina

O que significa ter câncer?

O que significa ter câncer? Essa pergunta ecoa silenciosamente nos corações de…

Create an Amazing Newspaper

Siga-nos

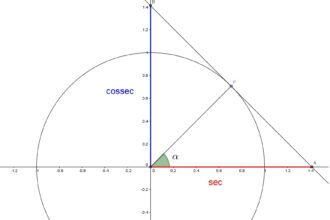

O que significa relações trigonométricas?

Você já se perguntou o que significa relações trigonométricas? Esses conceitos matemáticos,…

O que significa derivada na matemática?

Derivada na matemática é como uma chave mágica que nos permite desvendar…

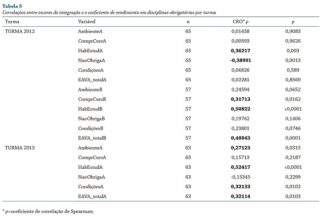

O que significa coeficientes?

Mergulhando no mundo dos números, nos deparamos com os misteriosos coeficientes. Esses…

O que significa álgebra?

Um mundo de incógnitas e equações complexas, álgebra é um ramo fascinante…

O que significa área na matemática?

Na matemática, a área é um conceito fundamental que nos permite medir…

O que significa aceleração na matemática?

A aceleração, na matemática, é um conceito fundamental que nos permite entender…

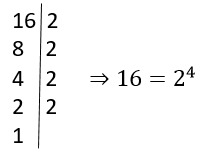

O que significa multiplicação?

A multiplicação é como uma poção mágica matemática que transforma um número…

O que significa trigonometria na matemática?

O que é a trigonometria? Para alguns, é o estudo dos números…

Create an Amazing Newspaper

Conteúdo patrocinado

O que significa capitalismo?

O que significa capitalismo? É um conceito que se desdobra em um verdadeiro oceano de interpretações e debates. Desde sua origem na Revolução Industrial até os dias atuais, o capitalismo abrange os pilares da propriedade privada, da livre iniciativa e do mercado competitivo. Mas, será que esse sistema econômico tem se mostrado eficiente e sustentável para todos? Exploraremos essas questões e muito mais neste artigo, mergulhando nas profundezas desse complexo sistema que molda nossa sociedade contemporânea.

O que significa NSFW?

O que significa NSFW? Essa sigla misteriosa tem se tornado cada vez mais comum nas redes sociais e nos ambientes digitais. Será alguma nova gíria? Na verdade, NSFW significa "Not…

Top Autores

Stay Up to Date

Subscribe to our newsletter to get our newest articles instantly!