- Anúncios -

O que significa ethnic?

A palavra "ethnic" é usada frequentemente, mas você já se perguntou o que ela realmente significa? Na verdade, "ethnic" refere-se às características culturais, linguísticas ou religiosas de um grupo de pessoas. É uma forma de identidade coletiva que ressalta a diversidade e a riqueza da nossa sociedade.

O que significa a palavra abide?

A palavra "abide" tem uma sonoridade misteriosa, como se escondesse segredos antigos. No entanto, sua definição é simples: "abide" significa "permanecer" ou "aguentar" em português. Apesar de sua simplicidade, essa palavra carrega consigo um profundo senso de resistência e determinação. Ao entender seu significado, podemos vislumbrar um mundo repleto de força interior e paciência incansável.

O que significa illegal?

O termo "illegal" em inglês significa "ilegal". Refere-se a algo proibido pela lei ou que não está de acordo com as normas estabelecidas. É importante respeitar a legalidade em todas as circunstâncias.

Medicina

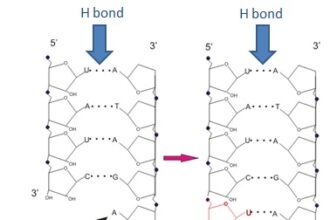

O que significa mieloma múltiplo?

Mieloma múltiplo, uma condição complexa e intrigante. Essa doença silenciosa é como…

Create an Amazing Newspaper

Siga-nos

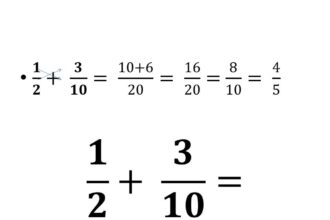

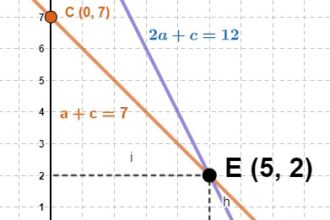

O que significa denominador?

Você já se perguntou o que significa denominador? Uma palavra tão peculiar…

O que significa equações polinomiais?

Você já se perguntou sobre o significado das equações polinomiais e como…

O que significa acima na matemática?

Na matemática, a palavra "acima" ganha um novo significado. Deixando de ser…

O que significa função afim na matemática?

A função afim na matemática é como uma dança matemática encantadora, na…

O que significa área na matemática?

Na matemática, a área é um conceito fundamental que nos permite medir…

O que significa equação de 2º grau?

A equação de 2º grau, também conhecida como equação quadrática, é um…

O que significa expressão numérica?

A expressão numérica, um enigma matemático envolto em símbolos, números e operações.…

O que significa potenciação?

Você provavelmente já se deparou com a potenciação em algum momento da…

Create an Amazing Newspaper

Conteúdo patrocinado

O que significa capitalismo?

O que significa capitalismo? É um conceito que se desdobra em um verdadeiro oceano de interpretações e debates. Desde sua origem na Revolução Industrial até os dias atuais, o capitalismo abrange os pilares da propriedade privada, da livre iniciativa e do mercado competitivo. Mas, será que esse sistema econômico tem se mostrado eficiente e sustentável para todos? Exploraremos essas questões e muito mais neste artigo, mergulhando nas profundezas desse complexo sistema que molda nossa sociedade contemporânea.

O que significa a sigla LGBTQIA+?

A sigla LGBTQIA+ representa a diversidade de identidades de gênero e orientações sexuais presentes na sociedade. Cada letra abraça uma expressão única, construindo uma comunidade unida em busca de igualdade…

Top Autores

Stay Up to Date

Subscribe to our newsletter to get our newest articles instantly!