- Anúncios -

O que significa chef?

O termo "chef" é uma junção de habilidades e paixão pela gastronomia. Ser um chef significa dominar não apenas a técnica, mas também a criatividade e a habilidade de combinar ingredientes de forma única. Um chef não apenas cozinha, mas cria, emociona e encanta através dos sabores. É um título que traz consigo a responsabilidade de inspirar e impressionar os…

O que significa cluster?

Clusters são como pequenos mundos dentro de um universo maior, conectando empresas e instituições para criar sinergias e promover o crescimento econômico. Essas concentrações de organizações são vitais para impulsionar a inovação, compartilhar conhecimento e fortalecer a competitividade de uma região. O que significa cluster? Significa uma rede de colaboração e prosperidade que impulsiona o desenvolvimento socioeconômico.

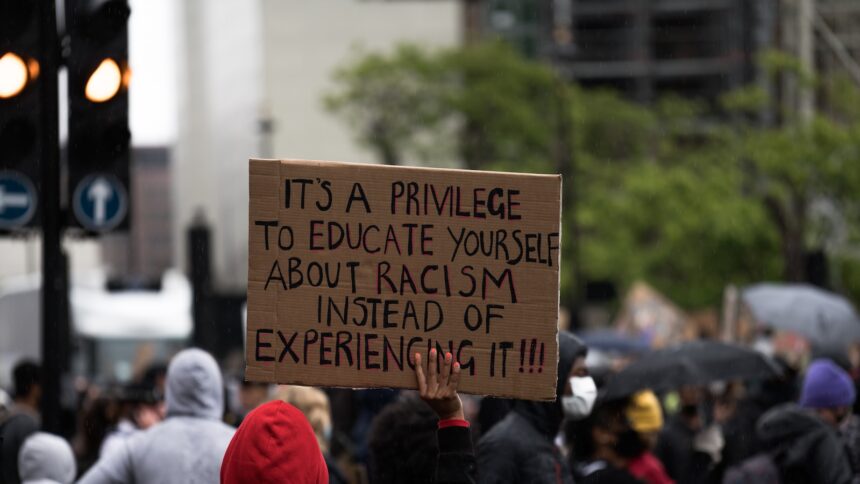

O que significa racial?

O termo "racial" é uma junção de raça e social, que descreve a interseção entre a identidade racial de uma pessoa e a dinâmica social envolvida. Busca compreender as experiências, desigualdades e discriminação enfrentadas por diferentes grupos étnicos, promovendo uma sociedade mais igualitária e inclusiva.

Medicina

O quê significar ser cetogênico?

Ser cetogênico significa seguir uma dieta que leva seu corpo a um…

Create an Amazing Newspaper

Siga-nos

O que significa hipotenusa?

A hipotenusa é como aquele amigo que sempre dá o suporte necessário,…

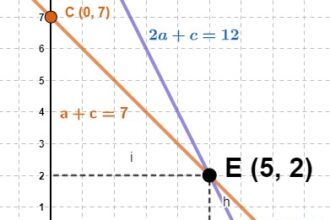

O que significa equação logarítmica?

Você já ouviu falar sobre equações logarítmicas? Essas expressões misteriosas podem parecer…

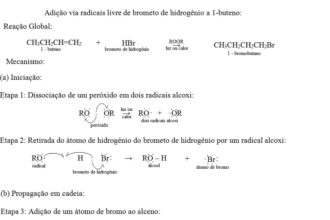

O que significa adição?

A adição, um conceito matemático fundamental, revela-se como um enigma estimulante para…

O que significa assíntota na matemática?

As assíntotas são como linhas invisíveis que atraem ou afastam uma curva,…

O que significa numerador?

Você já se perguntou o que significa numerador? No mundo da matemática,…

O que significa equações irracionais?

Você já se perguntou o real significado das equações irracionais? Elas são…

O que significa fórmula de Bhaskara na matemática?

A fórmula de Bhaskara, na matemática, é um marco que transcende a…

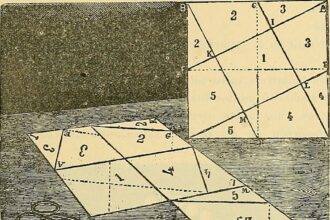

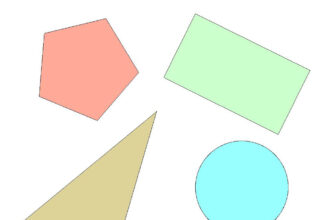

O que significa geometria?

Geometria, a palavra que une formas, linhas e figuras num mundo de…

Create an Amazing Newspaper

Conteúdo patrocinado

O que significa capitalismo?

O que significa capitalismo? É um conceito que se desdobra em um verdadeiro oceano de interpretações e debates. Desde sua origem na Revolução Industrial até os dias atuais, o capitalismo abrange os pilares da propriedade privada, da livre iniciativa e do mercado competitivo. Mas, será que esse sistema econômico tem se mostrado eficiente e sustentável para todos? Exploraremos essas questões e muito mais neste artigo, mergulhando nas profundezas desse complexo sistema que molda nossa sociedade contemporânea.

O que significa TGIF?

Você já deve ter visto ou ouvido a expressão TGIF, mas você sabe o que ela significa? As letras representam "Thank God It's Friday", uma expressão de alívio e felicidade…

Top Autores

Stay Up to Date

Subscribe to our newsletter to get our newest articles instantly!